Market Expansion

& Revenue Growth

Understand where the company is today and where it needs to go

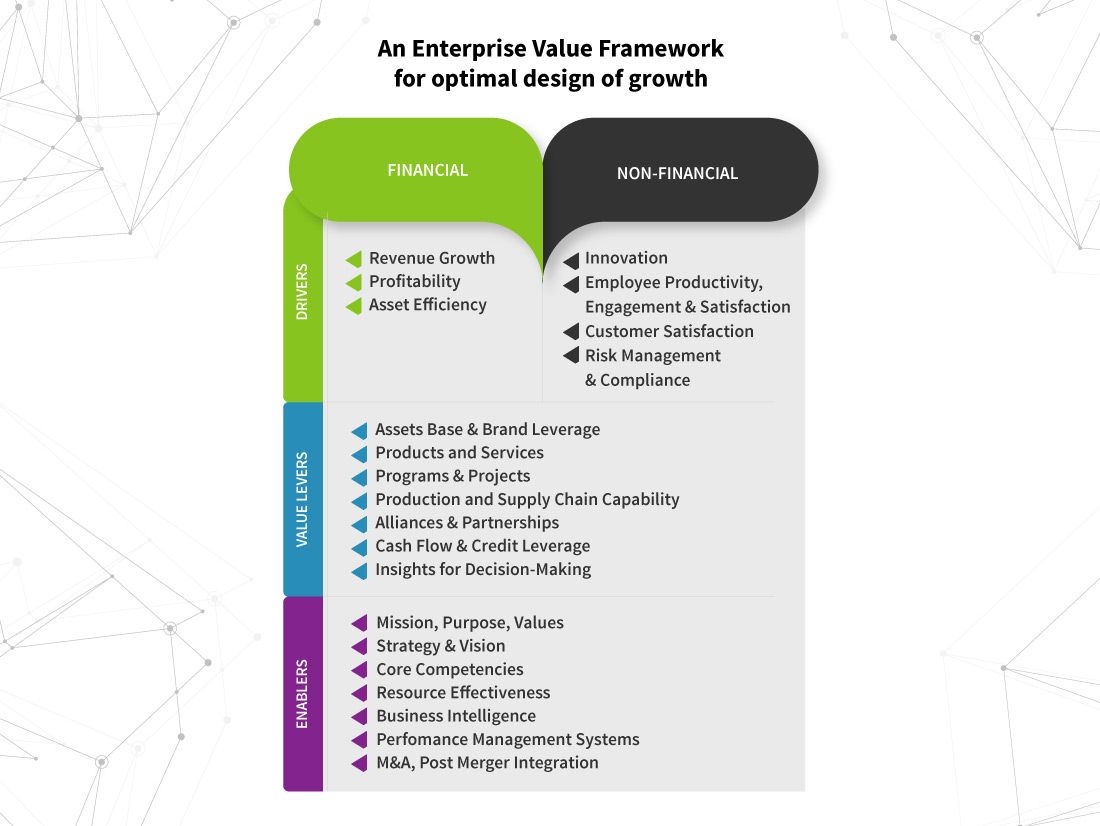

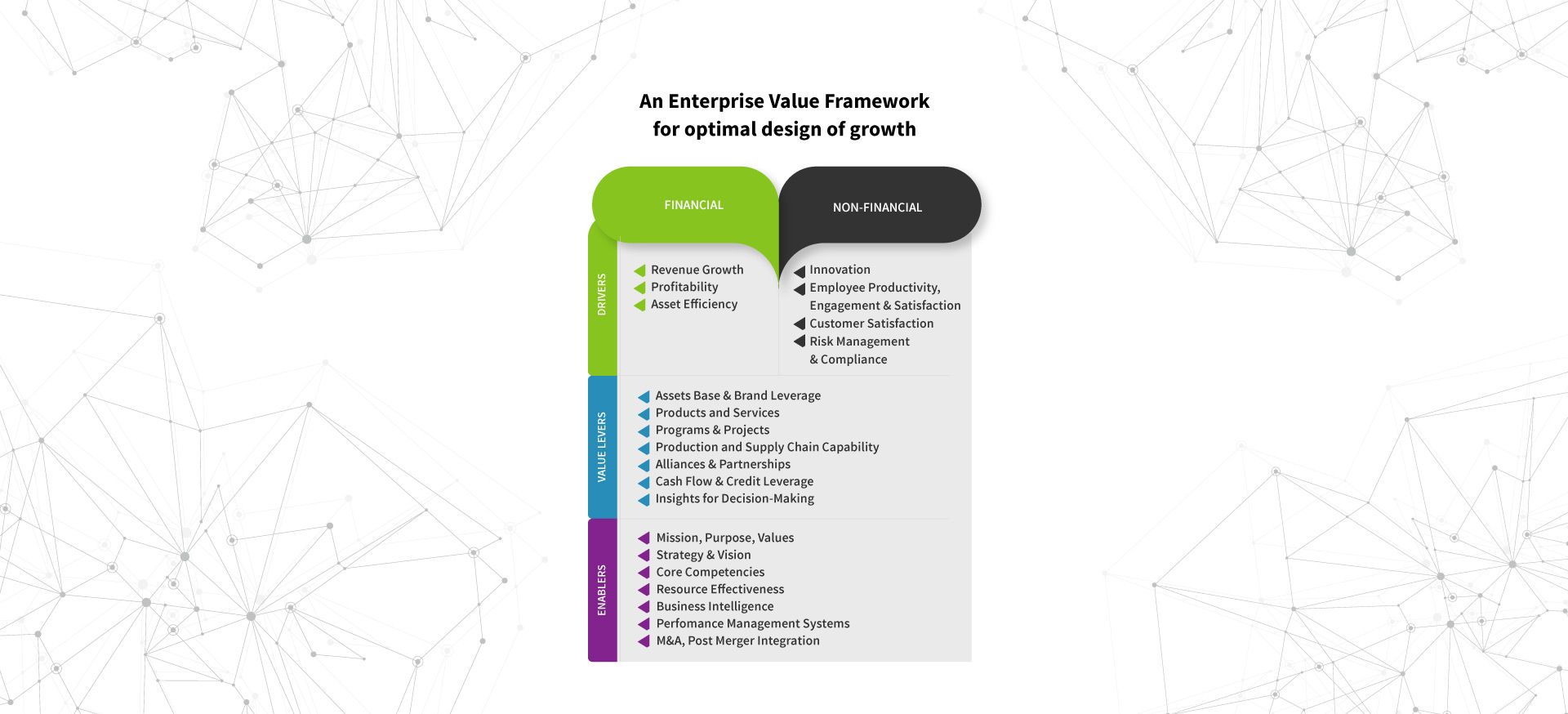

The three key financial drivers capable of increasing enterprise value are:

Non-financial enterprise value drivers include:

Enterprise Value Multiplier Framework

Future growth is inextricably linked to the strength of a firm’s present business and the success of the investments it is making.

The 4 factors affecting the intrinsic value of a company are tied to the company’s ability to generate differentiated product offerings that will boost cash flow growth in the future.

Central to the Enterprise Value Multiplier Framework is the alignment of the dynamics of the five Levers of Value.

It can be applied at the corporate strategy level and at the business unit level.