IT consulting, relates to services aimed at helping clients on how they can utilise information technology (IT) and digital to optimally achieve their business goals.

The IT consulting market is forecasted to face significantly higher demand, accelerating growth, on the back of technological trends, including digitisation, analytics, cloud, robotics, and the Internet of Things (IoT).

The type of work can range from strategic (such as developing a new IT strategy or IT cybersecurity approach) to tactical (such as the implementation of an ERP system or the selection of an IT system) to highly operational (such as the development of a mobile application).

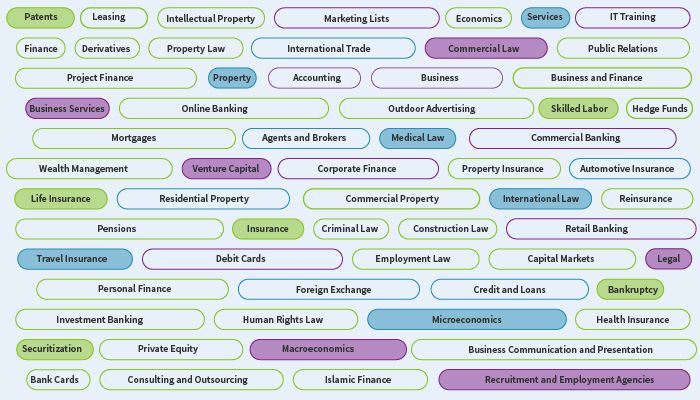

The market for IT consulting services consists of eight main disciplines: IT Strategy, IT Architecture, IT Implementation, ERP services, Systems Integration, Data Analytics, IT Security and Software Management.

IT strategy focuses on strategic IT propositions and IT advisory, offerings - the first phase of any IT undertaking., with engagements averaging two to three months.

IT architecture looks at the IT processes and systems, and defines the technological blueprint that enables business processes. Projects typically last between six to 12 months and architecture services precede any IT implementation or systems integration efforts. Consulting offerings include, among others, defining an enterprise landscape, implementing a service-oriented architecture (SOA), or guiding the outsourcing of architecture processes to an external vendor.

Enterprise Resource Planning (ERP) services are activities that support clients with designing, implementing ERP systems and modules; for instance, SAP or Oracle products.

IT security focuses on risk, security and compliance responsibilities in the IT landscape, while the IT implementation line of business encompasses all services related to the design and implementation of technology-driven projects.

Software management refers to the practice that involves managing and optimising the purchase, deployment, maintenance, utilisation, and disposal of software applications within an organisation.

Lastly, data analytics, an upcoming domain, centres around techniques and tools that can turn large amounts of data into valuable information in order to support decision making - business intelligence, workforce analytics, customer intelligence, data warehousing (big data) and predictive modelling.

IT Services Outsourcing research

The rise of next-generation technologies, such as mobility, analytics, cloud, automation, and other emerging technologies, offer opportunity to drive digital transformation. Our IT Services Outsourcing research delivers fact-based data and insights on key dynamics that help understand how to leverage IT and supporting technologies to address key business issues:

Digital Services | Cloud, Infrastructure & Application Services

Banking, Financial Services & Insurance - IT Outsourcing

Healthcare & Life Sciences IT Outsourcing

Business Services

Business Services