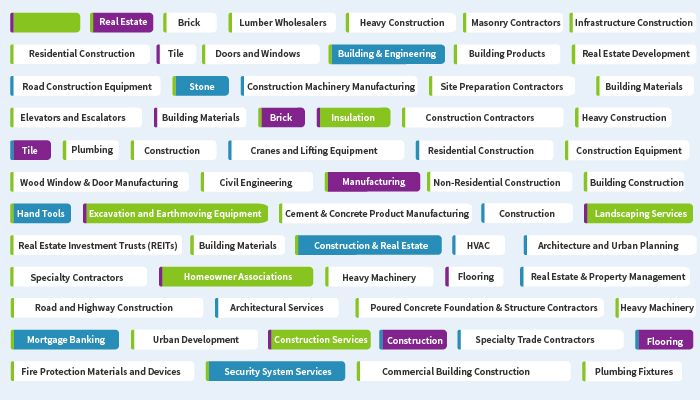

The Construction market includes markets for constructed buildings and engineering projects (e.g., highways and utility systems), and services provided by entities that prepare sites for new construction and those that subdivide land for sale as building sites.

The construction industry covers the residential, commercial, environmental and energy, industrial, transportation and defense sectors. Furthermore, the sector includes on-site assembly of prefabricated buildings.

Real-estate agents, residential and non-residential builders, contractors, engineering firms and heavy construction firms are the main sectors in construction industry.

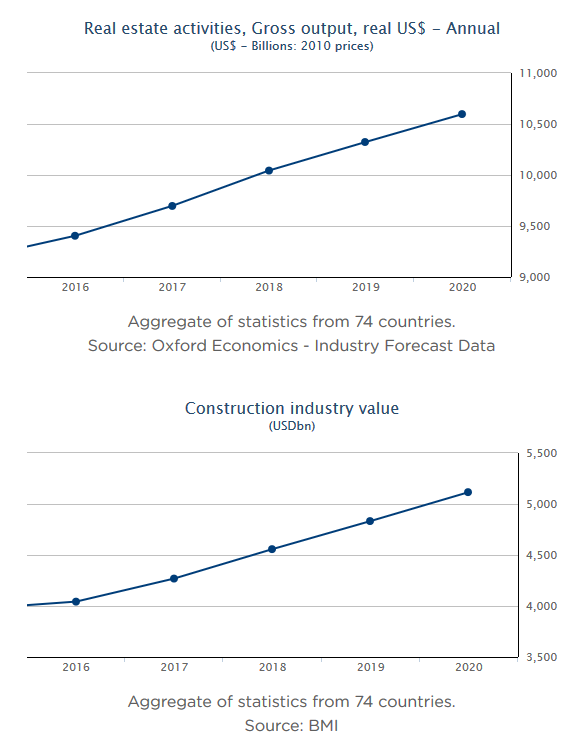

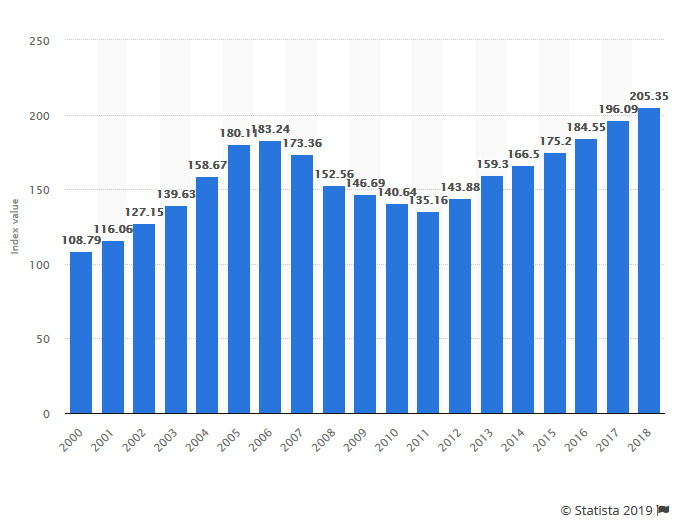

The global construction industry is growing rapidly. Population growth coupled with increased per capita income in emerging economies, and lower unemployment rate for advanced economies are driving market growth, and is estimated to grow at a CAGR of 4-5% in the next five years, with commercial construction poised to lead market growth.

Real Estate Buying, Selling and Renting: Information and market data on real estate buying, selling and renting.

Economic development is increasing demand for new constructions and expansions to existing infrastructures.

Asia-Pacific is expected to lead the construction market in the coming years, with China and India, and some Middle East countries driving the growth.

A noteable trend is for governments developing public-private partnerships (PPPs), to partner with construction companies to repair and upgrade national infrastructures.

Our reports contain facts and data on market sizes, revenue, value chain, price trends and regulations, leading players key developments, strategy and profiles.

Construction Industry | Green Focus

As the benefits of going green become clearer and more affordable, tenant and investor demands for sustainable buildings are increasing. Construction companies around the world are building more and more environmentally friendly buildings, and existing buildings are being upgraded to meet these standards as well. Green buildings can also have a demonstrable impact on the corporate bottom line.

The construction industry focus is on lower costs, faster delivery, and lower emissions:

Construction and Real Estate

Construction and Real Estate