Daily Update: May 4, 2021

Publication | Update:

May 2021

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

Vaccinations are being deployed across the United States. The American labor market is seeing a windfall of new employment, and consumer confidence is picking up. Companies’ probability of defaulting is declining. Such indicators point to a place of strength and stability for the U.S. recovery.

In the first quarter of this year, U.S. GDP expanded by an annualized 6.4%, and S&P Global Ratings Chief U.S. Economist Dr. Beth Ann Bovino expects 11.3% annualized growth in the second quarter.

“Matching exactly our forecast since March and confirming the build-up of momentum we had been tracking,” the first-quarter GDP growth “was strong in virtually every aspect, led by a 10.7% annualized surge in consumption—a reflection of improved vaccination rollouts, wider reopening and unprecedented government income support—with food and beverage purchased for off-premises consumption leading nondurable goods consumption growth and food service and accommodations leading service consumption growth,” Dr. Bovino said in a recent report.

Corporates across the country are capitalizing on the combination of fiscal and monetary policy in support of the rebound. S&P Global Market Intelligence found that U.S. companies’ bankruptcies slowed in April, and the potential for U.S. defaults remains low with median one-year probability of default scores declining across most sectors month-over-month. Defaults are trending lower. In the first quarter, the number of U.S. corporate upgrades rose 52%, to 99—the highest number since the third quarter of 2013 and the first time that upgrades outnumbered downgrades (which fell 25% to 66) since 2014, according to S&P Global Ratings.

U.S. President Joe Biden’s actions in his first 100 days in office have focused on pulling the country from the depths of the coronavirus crisis and reshaping broad swaths of the world’s biggest economy. Likewise, the Federal Reserve’s accommodative policy stance has driven its monthly purchases of $ 80 billion worth of Treasury securities and $ 40 billion worth of mortgage-backed securities during the pandemic. Moving forward, however, many industries may watch the administration closely as it aims to increase oversight and change tax laws in ways that could diminish corporate earnings and capital gains. The U.S. central bank, after having been transformed during the crisis by aligning its goals more closely to those of the federal government now than in recent years, may be complicated as it redefines its role in supporting the economy without undermining market stability. Market participants are now expressing and acting on concerns over the risk of inflation.

“We are in the camp that believes the pickup in headline inflation is tied primarily to resurgent economic activity after the pandemic-induced economic standstill and corresponding depressed prices last year. Against this backdrop, we expect the upward trend of corporate borrowers' cost pressures to moderate in the next year or two, as the economic recovery starts to level off and business activities normalize,” Dr. Bovino said in her report. “Moreover, we think industries will largely be able to manage rising prices through cost-saving strategies, productivity gains, or by passing them through to customers.”

While the U.S. economy’s recovery is a sign of a post-pandemic world to come, the road to normalization won’t be without obstacles. Globally, the U.S.’s outperforming recovery and unwinding of pent-up savings could result in faster growth and rising imports, which may widen the country’s current account deficit, according to S&P Global Ratings. This could sow disorder in the global economic recovery. Domestically, a storm of defaults could strike when the crisis is controlled.

"There's going to be a day of reckoning," Tim Weed, a partner at the professional services firm Plante Moran, told S&P Global Market Intelligence. "There's going to be some cleaning out of different parts of corporate America … We can paper over for a while, but eventually those things will come home to roost.”

Today is Tuesday, May 4, 2021 and here is today’s essential intelligence.

Market Dynamics

Healthcare IPOs Double YOY As Pandemic Drives Investor Interest In Q1'21

Global healthcare IPOs during the first quarter of 2021 more than doubled year over year as the pandemic highlighted the need for innovative therapies, vaccines and diagnostics. According to data compiled by S&P Global Market Intelligence, 84 healthcare companies went public globally, the highest number of first-quarter IPOs over the last five years. The total valuation of these offerings was $ 13.80 billion, more than double the $ 5.37 billion of offerings in the first quarter of 2020.

—Read the full article from S&P Global Market Intelligence

Dissecting the Performance of Indian Equity Active Funds in 2020

The percentage of active funds that underperformed their respective benchmarks in the Indian Equities Large-Cap and Mid-/Small-Cap fund categories over a one-year investment horizon doubled from 2019 to 2020, as seen in the SPIVA® India Year-End Scorecards for 2019 and 2020.

—Read the full article from S&P Dow Jones Indices

The Credit Cycle

Islamic Finance In Turkey: Capital Availability Is Likely To Constrain Growth In Coming Years

The Participation Banks Association of Turkey, in its newly updated strategy, expects a doubling of participation banks' market share to 15% by 2025. We see this objective as challenging given the difficult economic and credit conditions and the capital support that such growth implies.

—Read the full report from S&P Global Ratings

Islamic Finance 2021-2022: Toward Sustainable Growth

S&P Global Ratings expects stronger sukuk issuances and expanding market shares amid the modest recovery of core Islamic finance economies to boost Islamic finance assets by around 10%-12% over 2021-2022. Although the pandemic offered the possibility of more broad-based and transformative growth, the industry has not yet fully unlocked the opportunities inclusive standardization affords and increased its share of sustainable finance activity.

—Read the full report from S&P Global Ratings

Legislation In Several States Provides A Path To Securitization For Some Regulated Investor-Owned Utilities Affected By The Deep Freeze

On April 23, 2021, the February 2021 Regulated Utility Consumer Protection Act (SB 1050) was signed into law in Oklahoma, allowing utilities operating within the state to file with the Oklahoma Corp. Commission (OCC) for securitization of the incremental costs associated with the 2021 winter weather event.

—Read the full report from S&P Global Ratings

Banking Sector Under Pressure

Listen: Street Talk: Record Pace Of Fintech M&A, Funding In Q1'21 Has Legs

M&A and fundraising activity in the fintech sector has started at a torrid pace in 2021 and shows no signs of slowing. That was the message that Greg Smith, managing director and director of research at fintech-focused investment bank FT Partners, delivered in the latest Street Talk podcast.

—Listen and subscribe to Street Talk, a podcast from S&P Global Market Intelligence

Japan Regional Banks Face Thinning Buffer Against High Costs, Low Interest Rates

Some of Japan's regional banks may be forced to consolidate to survive, a consideration many have long been resistant to, as more banks are no longer earning sufficient income to cover operating expenses.

—Read the full article from S&P Global Market Intelligence

Technology & Media

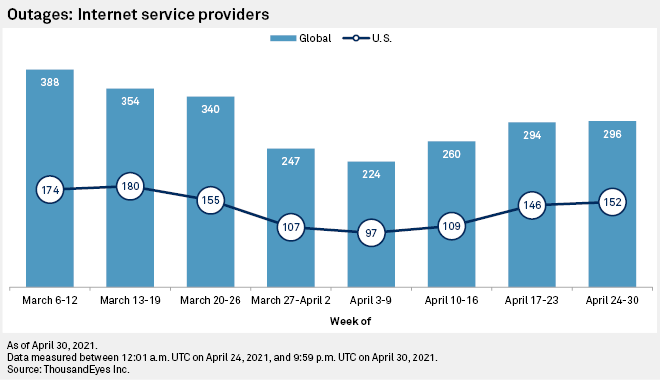

Global Internet Outages Continue To Edge Higher As April Ends

The week of April 24 marked the third consecutive weekly increase in the volume of global internet outages since a low point in early April, according to data from ThousandEyes, a network-monitoring service owned by Cisco Systems Inc.

—Read the full article from S&P Global Market Intelligence

New Debate On Whether Big Tech Buy-Ups Are 'Killer Acquisitions'

Big Tech companies have become, well, big — largely due to a slew of acquisitions over the years. Think of Facebook Inc.'s 2012 purchase of Instagram LLC; Amazon.com Inc.'s acquisition of Whole Foods Market Inc. in 2017; and Google LLC's buy of Fitbit Inc. in early 2021.

—Read the full article from S&P Global Market Intelligence

How The Chip Shortage Will Shake Up China's New Energy Vehicle Market

The global chip shortage that has disrupted automakers' operations in China since late 2020 will get worse before it gets better. Fast auto demand recovery since the second half of 2020 and increasing demand from consumer electronics largely explain the tight chip supply globally. S&P Global Ratings believes the shortage may slow but not derail the recovery of the Chinese auto sector.

—Read the full article from S&P Global Ratings

ESG in the Time of COVID-19

1st 100 Days: Biden Turns To Congress To Carry Out Climate, Clean Energy Push

U.S. President Joe Biden's first 100 days in office brought a flurry of executive actions involving climate change and energy policy. But many pieces of Biden's climate agenda, including key parts of his 10-year, $ 2 trillion infrastructure-focused American Jobs Plan, will require approval from Congress, where partisan divides and parliamentary procedures could determine the fate of those proposals.

—Read the full article from S&P Global Market Intelligence

Lawmakers 'Tweaking' ERCOT Market After Storm, But Big Changes Unlikely: Experts

Billions of dollars will be spent to ensure the Electric Reliability Council of Texas mid-February winter storm grid failure does not recur, but major market structure changes are unlikely, top power company executives said during the Gulf Coast Power Association's virtual Spring Conference.

—Read the full article from S&P Global Platts

Exxonmobil, Chevron Affirm Large Scale Carbon Capture Projects In Q1 Calls

ExxonMobil and Chevron confirmed their commitments to building large-scale projects to address climate change April 30, beginning with a focus on carbon capture. The companies remain among the world's largest producers of oil and gas, but the coming energy transition has loomed large and stirred excitement in the last year or so, which was reflected in separate Q1 earnings calls.

—Read the full article from S&P Global Platts

The Future of Energy & Commodities

Vietnam Mulls Loosening Oil Inventory Rules Amid Market Backwardation, Fragile Demand

Vietnam is considering lowering mandatory oil inventory levels at major oil companies to 20 days worth of domestic demand from the current 30 days, a move that could help local fuel distributors and exporters maximize their profits from the backwardation in the Asian market structure and flexibly manage their stockpiles amid fragile consumer demand recovery.

—Read the full article from S&P Global Platts

Iran Expects 2.5 Mil B/D Exports After US Sanctions Removal As Vienna Talks Continue

Iran expects to export as much as 2.5 million b/d of crude after the removal of US sanctions as the third round of talks between Tehran and some signatories to the nuclear agreement concluded in Vienna amid hopes of Washington removing oil sanctions on Tehran.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Standard & Poor's (S&P) is a leading index provider and data source of independent credit ratings. https://www.spglobal.com

Delivery Format:

HTML

Immediate Delivery

Access Rights | Content Availability:

Access Rights | Content Availability:

The content of this subscriber knowledge library area, the technology platform and tools are provided for information purposes only. No legal liability or other responsibility is accepted for any errors, omissions, or any loss, damage or inconvenience caused as a result of reliance on such information, or statements on this site, or any site to which these pages connect, since we cannot control the content or take responsibility for pages maintained by external providers. Where we provide links to sites, we do not by doing so endorse any information or opinions appearing in them. This courseware includes resources copyrighted and open educational resources (OER) by multiple individuals and organizations. If someone else is given access to your account login information, that person has read, understands and accepts the Conditions of Use for this platform.

Objectives and Study Scope

This study has assimilated knowledge and insight from business and subject-matter experts, and from a broad spectrum of market initiatives. Building on this research, the objectives of this market research report is to provide actionable intelligence on opportunities alongside the market size of various segments, as well as fact-based information on key factors influencing the market- growth drivers, industry-specific challenges and other critical issues in terms of detailed analysis and impact.

The report in its entirety provides a comprehensive overview of the current global condition, as well as notable opportunities and challenges.

The analysis reflects market size, latest trends, growth drivers, threats, opportunities, as well as key market segments. The study addresses market dynamics in several geographic segments along with market analysis for the current market environment and future scenario over the forecast period.

The report also segments the market into various categories based on the product, end user, application, type, and region.

The report also studies various growth drivers and restraints impacting the market, plus a comprehensive market and vendor landscape in addition to a SWOT analysis of the key players.

This analysis also examines the competitive landscape within each market. Market factors are assessed by examining barriers to entry and market opportunities. Strategies adopted by key players including recent developments, new product launches, merger and acquisitions, and other insightful updates are provided.

Research Process & Methodology

We leverage extensive primary research, our contact database, knowledge of companies and industry relationships, patent and academic journal searches, and Institutes and University associate links to frame a strong visibility in the markets and technologies we cover.

We draw on available data sources and methods to profile developments. We use computerised data mining methods and analytical techniques, including cluster and regression modelling, to identify patterns from publicly available online information on enterprise web sites.

Historical, qualitative and quantitative information is obtained principally from confidential and proprietary sources, professional network, annual reports, investor relationship presentations, and expert interviews, about key factors, such as recent trends in industry performance and identify factors underlying those trends - drivers, restraints, opportunities, and challenges influencing the growth of the market, for both, the supply and demand sides.

In addition to our own desk research, various secondary sources, such as Hoovers, Dun & Bradstreet, Bloomberg BusinessWeek, Statista, are referred to identify key players in the industry, supply chain and market size, percentage shares, splits, and breakdowns into segments and subsegments with respect to individual growth trends, prospects, and contribution to the total market.

Research Portfolio Sources:

Global Business Reviews, Research Papers, Commentary & Strategy Reports

M&A and Risk Management | Regulation

The future outlook “forecast” is based on a set of statistical methods such as regression analysis, industry specific drivers as well as analyst evaluations, as well as analysis of the trends that influence economic outcomes and business decision making.

The Global Economic Model is covering the political environment, the macroeconomic environment, market opportunities, policy towards free enterprise and competition, policy towards foreign investment, foreign trade and exchange controls, taxes,

financing, the labour market and infrastructure.

We aim update our market forecast to include the latest market developments and trends.

Review of independent forecasts for the main macroeconomic variables by the following organizations provide a holistic overview of the range of alternative opinions:

As a result, the reported forecasts derive from different forecasters and may not represent the view of any one forecaster over the whole of the forecast period. These projections provide an indication of what is, in our view most likely to happen, not what it will definitely happen.

Short- and medium-term forecasts are based on a “demand-side” forecasting framework, under the assumption that supply adjusts to meet demand either directly through changes in output or through the depletion of inventories.

Long-term projections rely on a supply-side framework, in which output is determined by the availability of labour and capital equipment and the growth in productivity.

Long-term growth prospects, are impacted by factors including the workforce capabilities, the openness of the economy to trade, the legal framework, fiscal policy, the degree of government regulation.

Direct contribution to GDP

The method for calculating the direct contribution of an industry to GDP, is to measure its ‘gross value added’ (GVA); that is, to calculate the difference between the industry’s total pretax revenue and its total boughtin costs (costs excluding wages and salaries).

Forecasts of GDP growth: GDP = CN+IN+GS+NEX

GDP growth estimates take into account:

Market Quantification

All relevant markets are quantified utilizing revenue figures for the forecast period. The Compound Annual Growth Rate (CAGR) within each segment is used to measure growth and to extrapolate data when figures are not publicly available.

Revenues

Our market segments reflect major categories and subcategories of the global market, followed by an analysis of statistical data covering national spending and international trade relations and patterns. Market values reflect revenues paid by the final customer / end user to vendors and service providers either directly or through distribution channels, excluding VAT. Local currencies are converted to USD using the yearly average exchange rates of local currencies to the USD for the respective year as provided by the IMF World Economic Outlook Database.

Industry Life Cycle Market Phase

Market phase is determined using factors in the Industry Life Cycle model. The adapted market phase definitions are as follows:

The Global Economic Model

The Global Economic Model brings together macroeconomic and sectoral forecasts for quantifying the key relationships.

The model is a hybrid statistical model that uses macroeconomic variables and inter-industry linkages to forecast sectoral output. The model is used to forecast not just output, but prices, wages, employment and investment. The principal variables driving the industry model are the components of final demand, which directly or indirectly determine the demand facing each industry. However, other macroeconomic assumptions — in particular exchange rates, as well as world commodity prices — also enter into the equation, as well as other industry specific factors that have been or are expected to impact.

Forecasts of GDP growth per capita based on these factors can then be combined with demographic projections to give forecasts for overall GDP growth.

Wherever possible, publicly available data from official sources are used for the latest available year. Qualitative indicators are normalised (on the basis of: Normalised x = (x - Min(x)) / (Max(x) - Min(x)) where Min(x) and Max(x) are, the lowest and highest values for any given indicator respectively) and then aggregated across categories to enable an overall comparison. The normalised value is then transformed into a positive number on a scale of 0 to 100. The weighting assigned to each indicator can be changed to reflect different assumptions about their relative importance.

The principal explanatory variable in each industry’s output equation is the Total Demand variable, encompassing exogenous macroeconomic assumptions, consumer spending and investment, and intermediate demand for goods and services by sectors of the economy for use as inputs in the production of their own goods and services.

Elasticities

Elasticity measures the response of one economic variable to a change in another economic variable, whether the good or service is demanded as an input into a final product or whether it is the final product, and provides insight into the proportional impact of different economic actions and policy decisions.

Demand elasticities measure the change in the quantity demanded of a particular good or service as a result of changes to other economic variables, such as its own price, the price of competing or complementary goods and services, income levels, taxes.

Demand elasticities can be influenced by several factors. Each of these factors, along with the specific characteristics of the product, will interact to determine its overall responsiveness of demand to changes in prices and incomes.

The individual characteristics of a good or service will have an impact, but there are also a number of general factors that will typically affect the sensitivity of demand, such as the availability of substitutes, whereby the elasticity is typically higher the greater the number of available substitutes, as consumers can easily switch between different products.

The degree of necessity. Luxury products and habit forming ones, typically have a higher elasticity.

Proportion of the budget consumed by the item. Products that consume a large portion of the

consumer’s budget tend to have greater elasticity.

Elasticities tend to be greater over the long run because consumers have more time to adjust their behaviour.

Finally, if the product or service is an input into a final product then the price elasticity will depend on the price elasticity of the final product, its cost share in the production costs, and the availability of substitutes for that good or service.

Prices

Prices are also forecast using an input-output framework. Input costs have two components; labour costs are driven by wages, while intermediate costs are computed as an input-output weighted aggregate of input sectors’ prices. Employment is a function of output and real sectoral wages, that are forecast as a function of whole economy growth in wages. Investment is forecast as a function of output and aggregate level business investment.

APU Content Aggregation Service

APU Content Aggregation Service